Designing a unified financial platform to replace fragmented workflows

Leading the strategic design, UX, and launch of a brand new B2B platforms to replace fragmented internal workflows with a unified, systems-driven process.

Roles & Responsibilities

Senior UX Designer

Head of Design

Product Strategist

Systems Designer

Design Governance

Information Architect

Software & Methods

Figma

LucidSpark / LucidChart

Zeplin

Confidentiality Notice: Due to the proprietary and sensitive nature of my work in FinTech/B2B platforms at Raistone, all specific branding, sensitive financial data, and confidential text have been omitted, generalized, or anonymized in accordance with professional agreements. Full, unredacted details and further strategic insights are available for discussion in a live interview setting only.

Intro

I was brought in to lead the design and product strategy for Raistone's first-ever Client Portal, building the platform entirely from concept to launch. The core challenge was transforming a fragmented and manual sales-to-underwriting process into a unified, self-service digital journey. By creating a holistic system that mapped the entire client lifecycle—from qualified lead through transacting client—the objective was to accelerate deal velocity, reduce operational friction, and serve as the scalable foundation for Raistone’s revenue growth while boosting client satisfaction.

Discover

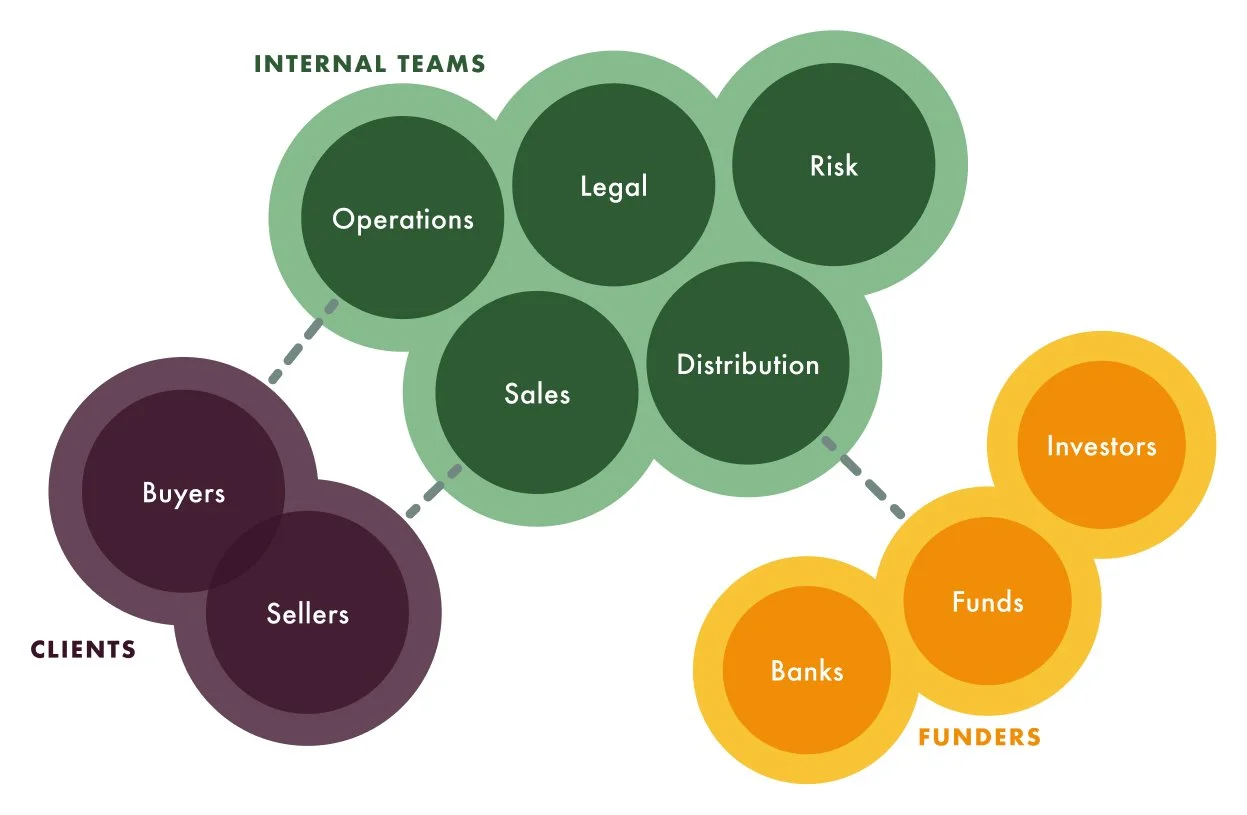

The Trade Finance Ecosystem: A simplified overview mapping the key users—Clients (Buyers, Sellers), Internal Teams, and Funders (Banks, Funds, Investors)—and their most critical interconnections.

When I joined Raistone, the business was scaling quickly, but the client journey was severely bottlenecked by a manual, non-standardized process. The lack of a unified digital experience meant that essential steps—particularly the KYC (Know Your Customer) / KYB (Know Your Business) underwriting process—were inefficient. This placed a huge burden on our Sales and Risk teams, leading to an average deal closing time of 45 days and excessive operational costs.

The Paper Chase

The extensive manual nature of KYC/KYB (uploading financial documents, answering detailed questions) caused major deal delays and high operational costs.

Internal Silos

The underwriting process was fragmented, with the Risk team driving requirements that the Sales team had to manually relay, increasing error rates and client frustration.

Unifying the Funnel

The old system lacked a unified view. We needed a single client journey that aligned with the entire sales funnel (Application → Onboarding → Underwriting → Closing → Client Transacting).

The 45-Day Anchor

The complexity of manually gathering necessary financial documents meant the deal closing timeline was slow and unpredictable. Our primary challenge was accelerating the time-to-revenue.

Define

Strategic Objectives

Our mandate was to use the new Client Portal initiative to achieve four critical business and operational outcomes:

Accelerate Time-to-Revenue

Reduce the average deal closing time (currently 45 days) by digitalizing the manual back-and-forth communication process.

Enable Scalability

Establish a reliable, self-service channel that reduces the operational burden on Sales and Risk teams, allowing the business to handle a greater volume of client opportunities.

Institute a Unified Data and Experience Model

To map the entire client journey (from initial Lead/Opportunity through Underwriting and final Transacting) into a single source of truth, eliminating the messy, fragmented email chains that confused clients and stalled deals.

Establish Product Consistency

To integrate UX into the core business operation, guaranteeing that all feature development rigorously balanced stakeholder requirements with validated user needs before development began, proving design's value to the core business operation.

Product Strategy in Action: Visualizing the complex, end-to-end customer journey, which served as the architectural blueprint for the entire Client Portal platform.

The challenge was not just about the UI, but about the process required to build and launch the product.

Implementing the UX/Product Delivery Model

When I joined as the first UX hire, the entire Product team was new. The existing workflow had Engineering receiving requirements directly from business teams. My most important early deliverable was to define and implement a design process that integrated UX into the existing development cycle.

Process Integration: Working with the CPO and PMs, we formalized a Product-led process. I used the Business Requirements Document (BRD) to inform my work, but my deliverable was the single source of truth for the experience—high-fidelity UIs and detailed screen flows—ensuring design was aligned with the future technical architecture.

Empathy Under Constraint: Since direct client access was initially restricted, I leveraged my prior experience as a business owner. I conducted intensive research with internal teams (Sales, Risk, Operations) to build a robust client persona and fill the empathy gaps, ensuring the designs were deeply practical for a business owner/CFO.

The Design Delivery Process

To ensure consistency and quality, I established the mechanism for design handoff and collaboration with engineering:

Handoff Excellence: I implemented a Design Delivery Process using Zeplin (and later, Figma Dev Mode). This provided Engineering and QA specialists with crystal-clear screen flows and logic documentation, ensuring high fidelity to the original design and drastically minimizing technical debt.

Increased Accuracy: This new process ensured the final product was consistent and usable, elevating the quality standard for our client-facing platform.

This diagram illustrates the unified Product Delivery Process I co-created with the Product team. We added the design work alongside the product requirements flow to guarantee design and requirements matched. This allowed engineering to review and confirm the design could be built before development started, which set accurate timelines and accelerated the technical speed of the Client Portal launch.

Develop

Product Requirements & Information Architecture

To successfully build the Client Portal from scratch, we architected the platform around the entire client journey. My initial design blueprint defined the following required modules and features, ensuring the underlying architecture could support future scalability:

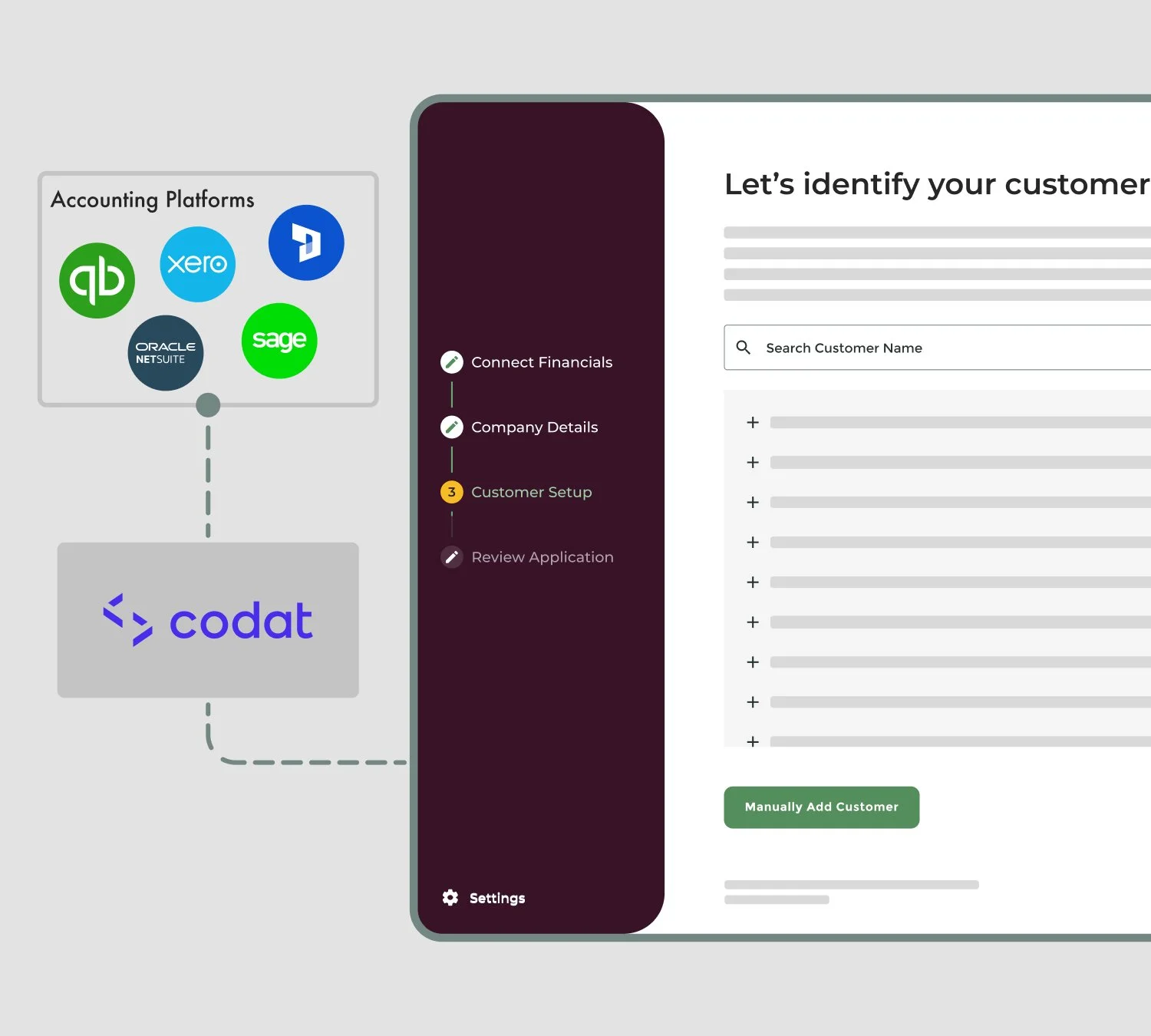

Onboarding Module (Phase 1 MVP) The most critical piece: automating the initial client information gathering. The goal was to transform the manual, week-long process into a 20-minute, self-service flow and integrate necessary financial connections (Plaid/Codat) to accelerate qualification.

User Management & Settings Essential for scalability, this functionality allowed business owners to securely manage colleagues' access and permissions for handling confidential document submissions.

Support Module To consolidate client inquiries into a single internal queue (integrated with the CRM) rather than fragmented email threads, improving transparency and response times.

Due Diligence (KYB/KYC) Documents Designed to be the central, streamlined repository for all complex financial and legal documents requested by the Credit Risk team. This module directly targeted the longest, most painful bottleneck in the entire underwriting process.

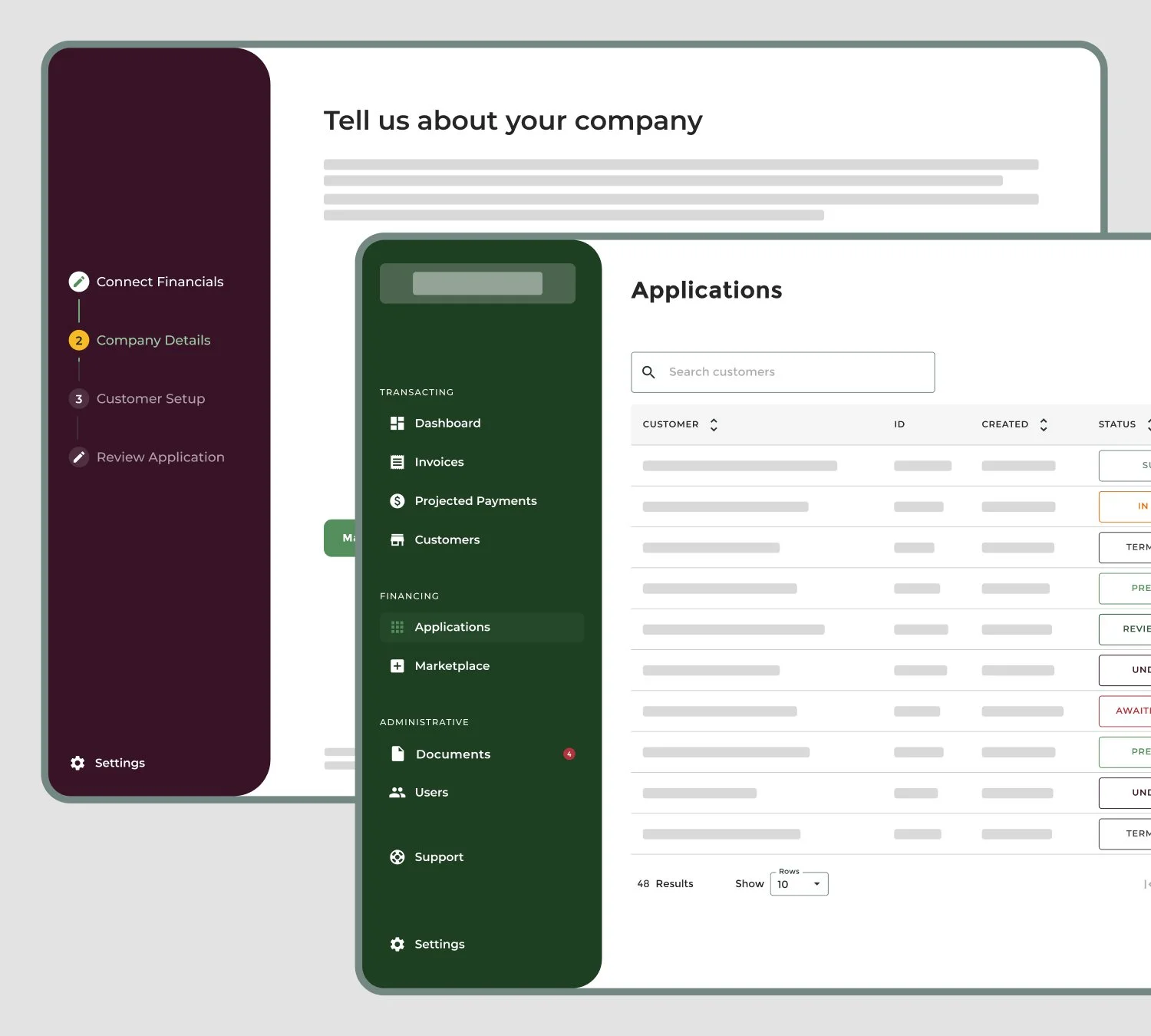

Transacting Module A key strategic feature for increasing client retention and stickiness. We designed an intuitive interface to replace the cumbersome legacy system, allowing existing clients to easily track payments and apply for additional financing.

The IA we created was modular, strategically defining core pillars to address every stage of the funnel.

The Information Architecture (IA) Blueprint: Mapping the Client Portal's modular structure, showing the six primary feature modules and their specific functional areas.

Transforming 3 Weeks of Email into a 20-Minute Digital Path

The original underwriting process averaged 45 days and required 1-2 weeks of manual, back-and-forth email to gather initial lead information. The goal of the new Onboarding flow was to transform this into a sequential, intuitive digital experience.

The design structure was architected to guide clients through a complex, mandatory process with maximum transparency and minimal friction. By presenting information in logical, digestible steps, we not only aimed to increase client satisfaction but directly supported the sales funnel by validating leads faster and ensuring all mandatory fields were completed. This system reduced the manual time requirement for initial information gathering from 1 week down to 20 minutes of client self-service, a 95% reduction in internal processing time for this step.

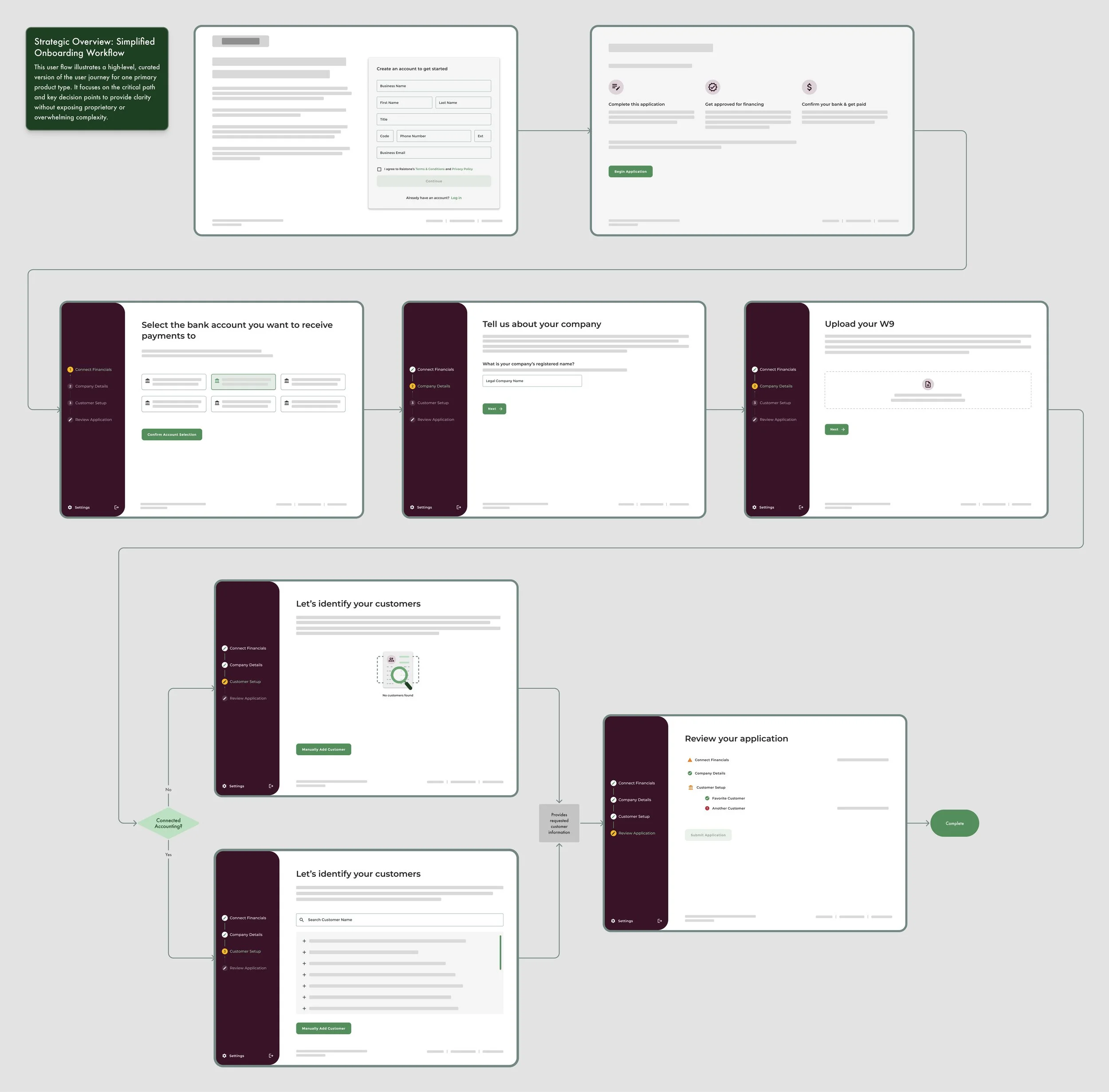

The Onboarding Module's modular architecture: This diagram highlights the configurable structure and logic, ensuring the workflow dynamically adapts to various client types and products without requiring code changes.

Design

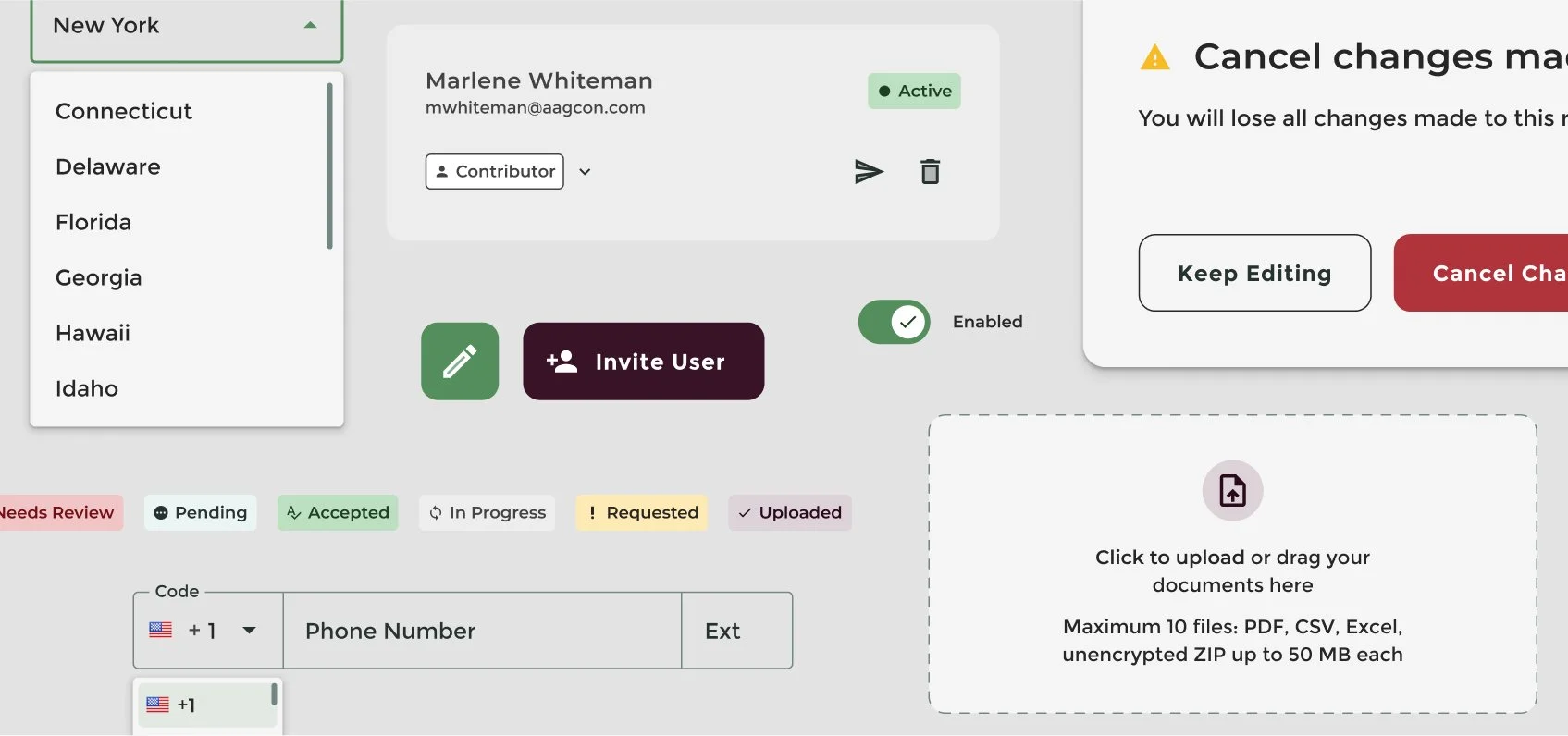

High Fidelity Prototypes

The execution of the designs focused entirely on quality, consistency, and an efficient handoff process for our engineering partners. Crucially, this high standard was achieved by leveraging and building the Raistone Design System—the essential framework that ensured all high-fidelity designs were modular, scalable, and on-brand, directly contributing to quality and preventing technical debt.

Translating Complexity: Logic Over Pixels

Visualizing the solution required more than just designing a final interface. It meant creating a robust system blueprint to manage complex financial workflows. The final design showcases the underlying and strategic system logic. This logic was essential for our team to meet financial requirements set by the business, ultimately allowing us to drive a simplified, cohesive client experience.

Strategic overview of the simplified Onboarding Workflow: this diagram illustrates a high-level, curated user journey for one primary product type. The flow intentionally focuses on the critical path and key decision points to provide clarity and context on the user experience without exposing the full complexity of the production workflow.

Due to client confidentiality, all screens are heavily redacted. I’m happy to walk through the complete, unredacted design logic, user interactions, and architecture during a live interview session.

Onboarding Module

The Onboarding Module was designed specifically to accelerate deal velocity by guiding users through the mandatory qualification process with maximum clarity and minimal friction.

Key Features

Intentional Design for Flow State

To reinforce the linear, step-by-step nature of the qualification process, the Onboarding Module utilized a distinct color palette and navigational structure. This was intentionally different from the main Client Portal, clearly signaling to users that they were within a unique, sequential experience that required completion.

Accelerated Data Intake

We integrated directly with Codat and Plaid early in the flow to immediately access necessary accounting and banking data. This feature was designed as a critical business lever for accelerating future underwriting and allowing the system to automate data collection even while internal business adoption models were still being formalized.

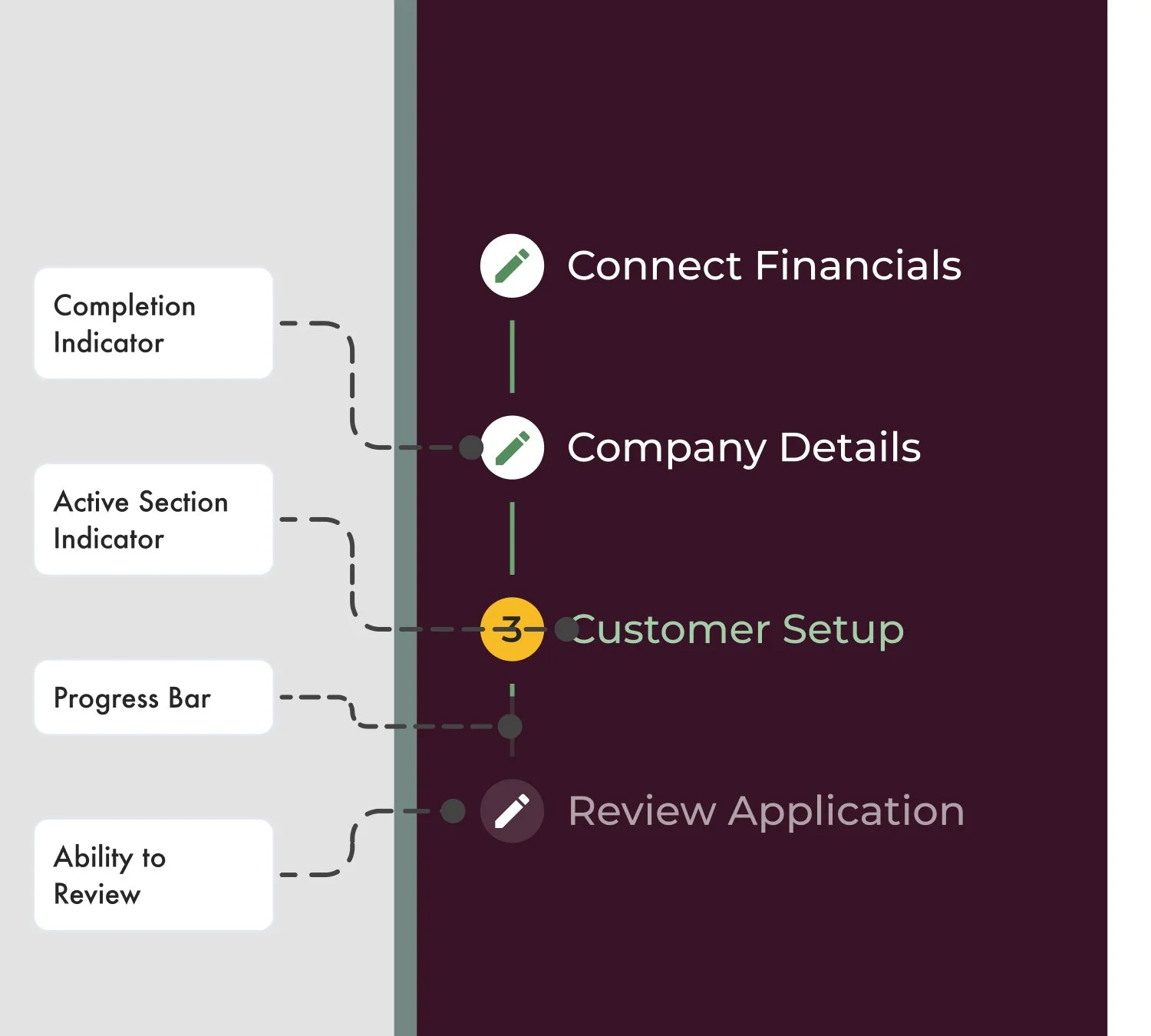

Enhanced User Orientation and Progress

A side navigation and progress bar were implemented across every Onboarding Module screen. This provided users with continuous, clear context regarding their current status and remaining steps, a crucial tool for mitigating frustration and reducing drop-off in a long, mandatory flow.

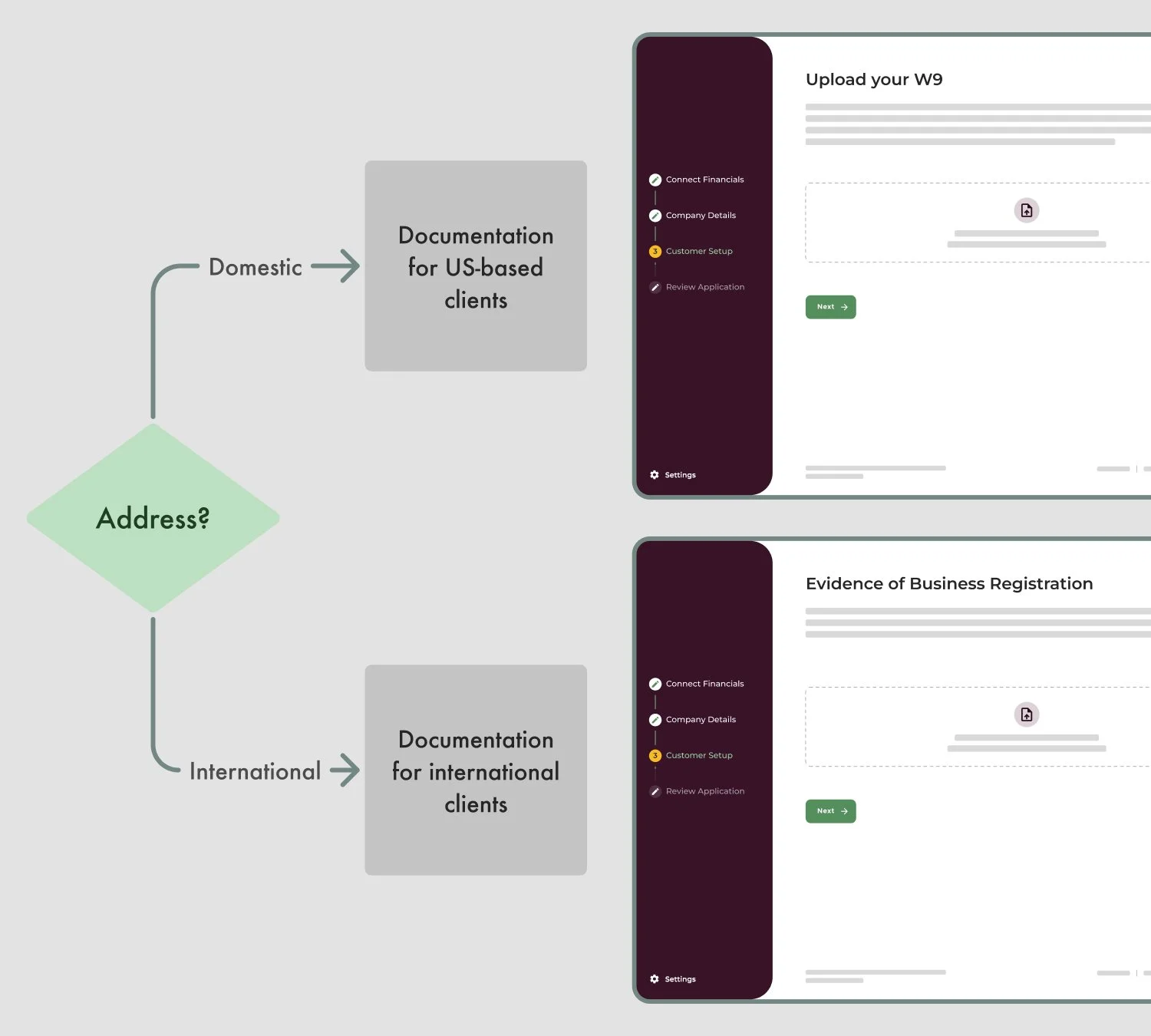

Dynamic and Conditional Logic

The core of the UX featured conditional logic. This dynamic flow adjusted requirements based on user inputs. For example, the flow would conditionally request a W-9 form only for U.S. addresses, or automatically present an imported customer list if the client connected their accounting system. This minimized manual data entry for users while strictly adhering to compliance rules.

Transacting Module

Design Completed & Validated: The final high-fidelity design for the Transacting Module achieved internal QA sign-off and was successfully validated by usability testing internally before the project was put on hold. It demonstrates the system’s capacity to handle complex data management in a clean and simple UI.

Due to client confidentiality, all screens are heavily redacted. I’m happy to walk through the complete, unredacted design logic, user interactions, and architecture during a live interview session.

The Transacting Module Dashboard and Invoices view: High-fidelity UI design visualizing real-time financial data, credit limits, and complex filtering necessary for effective fund management and decision-making.

Due Diligence Module

Strategic Execution: The Due Diligence workflow was fully designed and aligned with Sales and Risk team requirements, achieving stakeholder sign-off on the complex logic and document routing before development was paused.

The Due Diligence and Documents Module: UI designs showing the centralized document request and tracking system alongside the user's dashboard for uploading required compliance and financial documents

Design System Cross-Reference

All modules were built using the newly established Design System to ensure brand cohesion and technical speed. The quality, speed, and cross-functional acceptance of these designs were made possible by the dedicated Design System governance I led together with the Senior Developer. For a deep dive into the governance, standards, and architecture of this project, please see the Raistone Design System Case Study.

Experience Vision, Product Strategy, and Roadmap

My role quickly expanded past design. I led the long-term vision for the Client Portal and ensured its architecture could support our future product growth, even when I faced challenges getting full buy-in for new initiatives.

Integrated Vision and Roadmap

I focused on creating one seamless client journey—a single, cohesive experience from initial application through to the final transaction. This systems thinking directly influenced the roadmap I co-maintained with the PMs, prioritizing the modular Information Architecture (IA) to support scalability and future, more complex features.

Strategic Alignment

Co-maintaining the product roadmap required constant awareness of cross-system dependencies. Since the Client Portal integrated with evolving systems like the CRM, I had to be aware of other products' initiatives, launches, and delays, ensuring the Client Portal's evolution never caused issues with other systems—this was key to successfully moving the business forward.

Designing for Future States

My design vision consistently looked beyond the current Minimum Viable Product (MVP). While the IA diagram was simple, I designed the system to integrate future modules, like Executing Documents, directly into the architecture ensuring they could be easily built later when internal technology, such as the CRM, and business processes were ready.

Prototyping and Socializing the Vision

I created advanced, high-fidelity prototypes in Figma and used them to present and socialize the experience vision to both internal teams and key external stakeholders, such as potential business partners. This helped secure early support and align expectations.

Conclusion

The Foundational Challenge

This was not just a UI problem, but an organizational systems challenge. The project established the critical digital structure necessary for Raistone's future growth by replacing fragmented, manual processes and laying the groundwork for continuous product strategy evolution.

Strategic Impact & Measured Results

We achieved significant, measurable outcomes that validated our systemic approach:

Reduced Friction & Accelerated Revenue

We transformed the week-long, manual information intake process into a 20-minute, self-service digital flow, proving that design could directly solve lagging business processes.

Established a Foundational System

We created a scalable design system that immediately contributed to 30% faster design-to-development cycles, ensuring future products would not suffer from technical debt.

Launched a Unified Platform

Successfully built the organization's first single source of truth for the core client qualification and underwriting lifecycle, eliminating reliance on fragmented legacy systems.

Takeaways

I led the design and product strategy for the brand-new Client Portal, successfully moving Raistone from a fragmented, manual process to a self-service, unified platform. This initiative was foundational, and its key outcome was accelerating the entire client journey and enabling the business to close deals significantly faster.

Securing Organizational Mandate

The most important lesson learned for me was that true systemic transformation requires influence over the entire organizational process. Product success was ultimately limited by the lack of mandate to enforce change across business teams. With this, I now prioritize securing executive sponsorship over internal business processes and support from business teams from day one to ensure product adoption aligns with strategic intent.

Comfort with Ambiguity

Operating in a FinTech and a rapidly moving environment meant frequently navigating fluid requirements and competing stakeholder priorities. I successfully managed this ambiguity by grounding every decision in core IA and UX principles, and continuously aligning the design vision with the business' evolving risk and strategic needs.

Process Over Pixels

The biggest bottleneck was the internal product delivery process, not the final UI. To achieve true design scale, I focused together with the Product Managers on identifying and fixing fragmented internal workflows before translating them to digital screens, proving that systemic process transformation is a prerequisite for any successful enterprise product launch.

Design System as a Strategic Necessity

Together with the Senior .NET Developer, I recognized immediately that the lack of a system and component library would critically slow development velocity and compromise quality at scale. I proactively led the creation and governance of the Design System from day one to establish a single source of truth, ensuring the new platform could be built with necessary speed and engineering alignment.

The Systemic Foundation of the Client Portal

This successful client experience was built on a foundation of proactive design strategy. See how I defined the standards, governance, and architecture to accelerate development by reading the full Raistone Design System case study.